Capital Budgeting is defined as the process by which a business determines which fixed asset purchases or project investments are acceptable and which are not. Using this approach, each proposed investment is given a quantitative analysis, allowing rational judgment to be made by the business owners. IRR is the discount rate when the present value of the expected incremental cash inflows equals the project’s initial cost.

Throughput Analysis

Project management software will help to plan, manage and track that project to ensure that it is delivered on time and within the budget. Everyone wants to know that they can pay back their investment in as short of a time as possible. Although this might not be the most important metric in every scenario, it’s certainly one that should always be considered.

Geopolitical Risks

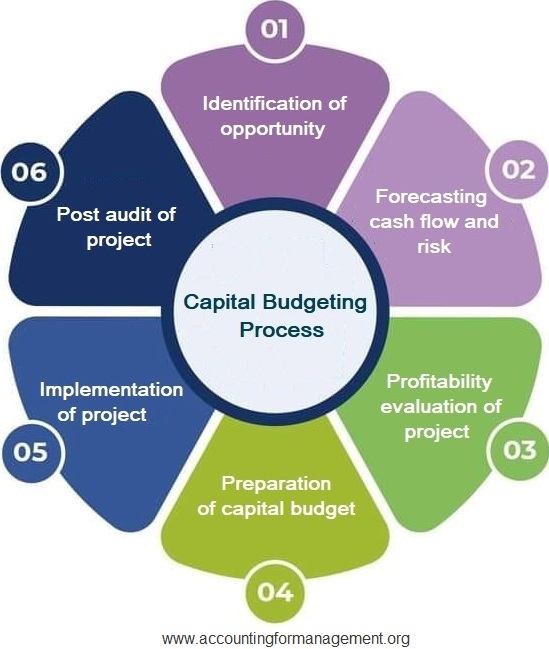

Four of the most practical and used techniques are Net Present Value (NPV), Internal Rate of Return (IRR), Payback Period, and Profitability Index. The projects that pass profitability test in this step are marked as accepted and the ones that fail are left as rejected. Only accepted projects qualify for the next step – preparation of capital budget.

Capital Budget: Understanding The Role and Process in Financial Management

There is no single method of capital budgeting; in fact, companies may find it helpful to prepare a single capital budget using the variety of methods discussed below. This way, the company can identify gaps in one analysis or consider implications across methods that it would not have otherwise thought about. An example of a project with cash flows which do not conform to this pattern is a loan, consisting of a positive cash flow at the beginning, followed by negative cash flows later. The greater the IRR of the loan, the higher the rate the borrower must pay, so clearly, a lower IRR is preferable in this case. If the estimated profits are $500 for each of the next 3 years, and your initial investment was $1000, then your projected payback period is 2 years ($1000 / $500). With this capital budgeting method, you’re trying to determine how long it’ll take for the capital budgeting project to recover the original investment.

Once a company has paid for all fixed costs, any throughput is kept by the entity as equity. Companies are often in a position where capital is limited and decisions are mutually exclusive. Management usually must make decisions on where to allocate resources, capital, and labor hours.

Decision Criteria

The practice ensures a win-win situation, where both the firm and the society it operates in reap the benefits. These techniques, however, serve as guides— they don’t guarantee the success of a project. Other factors such as the economic environment, political stability, and unforeseen fluctuations in industry trends could affect a project’s outcomes.

Capital budgeting is important because it creates accountability and measurability. Any business that seeks to invest its resources in a project without understanding the risks and returns involved would be held as irresponsible by its owners or shareholders. Furthermore, if a business has no way of measuring the effectiveness of its investment decisions, chances are the business would have little chance of surviving in the competitive marketplace. It is a challenging task for management to make a judicious decision regarding capital expenditure (i.e., investment in fixed assets). In any project decision, there is an opportunity cost, meaning the return that the company would have received had it pursued a different project instead.

While companies would like to take up all the projects that maximize the benefits of the shareholders, they also understand that there is a limitation on the money that they can employ for those projects. Therefore, they utilize capital budgeting strategies to assess which initiatives will provide the best returns across a given period. Owing to its culpability and quantifying abilities, capital budgeting is a preferred way of establishing if a project will yield results. In summary, the budgeting process itself creates two capital budgeting problems.

However, the final decision lands on various factors like management bias, organizational capability, and project risk. Deciding which method to use depends on the nature of the project, the strategic goals of the company, and the preferences of the decision-makers. top 134 accounting interview questions and answers pdf Although it considers the time value of money, it is one of the complicated methods. Let us go through some examples to understand the capital budgeting techniques. NPV is the sum of the present values of all the expected cash flows in case a project is undertaken.

- In a globalized economy, geopolitical risks have become a crucial factor in capital budgeting decisions.

- A capital budget is how a business makes decisions on its long-term spending.

- Capital budgeting is important as it provides businesses with a way to evaluate and measure a project’s value against what they have to invest in that project.

- Therefore, businesses need capital budgeting to assess risks, plan ahead, and predict challenges before they occur.

After the project has been finalized, the other components need to be attended to. These include the acquisition of funds which can be explored by the finance department of the company. The companies need to explore all the options before concluding and approving the project.